Spotlight On … The 2011 Census Data

Census Release

The much anticipated 2011 Census data has now been released. Providing invaluable demographic data to guide planning and marketing across public, commercial and not-for-profit sectors, the data confirms Australia as the world’s most culturally diverse population.

The trends of the past decade are clear. As well as more and more Australians having strong connections with overseas cultures, the composition and breadth of that diversity is changing markedly. Marketers and planners can no longer afford to ignore the evidence and the implications it has for successful delivery of goods and services.

In this article we highlight national trends across Australia for the periods 2001 to 2011 and 2006 to 2011.

Australia – a Land of Increasing Diversity

Some 5.3 million people living in Australia (26.1%)1 in 2011 were born overseas. This number has grown by 880,000 (19.9%) since 2006 – more than double the rate of growth of the Australian-born population over the same period. Reinforcing this trend, almost 73% of responses in 2011 indicated an overseas ancestry – up from 68.2% in 2001.

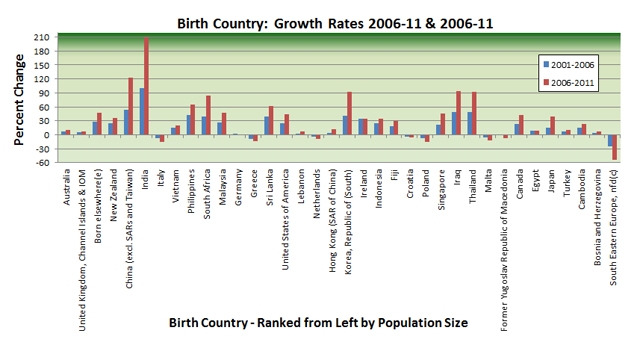

And the cultural mix is changing rapidly. For the first time, Australia is now home to more people born in India than the combined number of people born in Greece and Italy. The number of Indian-born has more than tripled in ten years, and doubled since 2006. The Chinese-born population has more than doubled since 2001 and its proportion in the mix has increased by over 95% – primarily, it would appear, due to significant growth from the Mandarin speaking areas of China.

Other communities showing significant growth since 2001 include people born in Iraq, Korea, Thailand, South Africa, Philippines and Sri Lanka – all registering growth rates of well over 50%. Countries of birth registering slightly less growth include Malaysia, Singapore, Canada and the US. Less spectacular are the continued growth since 2001 of more established communities such as people born in New Zealand (+35.9%), Indonesia (+33.9%), Fiji (+28.7%) and Vietnam (+19.5%).

Communities in relative decline include people born in Greece, Italy, Malta and most mainland European countries although the ancestry responses continue to show growth reflecting a strong second and third generation cultural identity. The only responses showing absolute decline since 2006 are those identifying with Serbian and Australian ancestry.

Also of significance is the proportion of people born in countries that are not represented in the top 35 countries of birth (“Born Elsewhere”). This now represents 4.4% compared with 3.4% in 2001, suggesting that Australia is attracting more and more people from the traditionally less well represented parts of the world, including Afghanistan, Sudan and Ethiopia.

Using Cultural Information for Better Business Decisions

Each community group, irrespective of current size, warrants specific attention. Each has its own culture characterised by distinctive attitudes, beliefs, values and needs and, as evidenced from the 2011 census data, has a growing presence in the Australian market. More meaningful connections with culturally defined market segments can be achieved by subtle differentiation of advertising messages and images, product features and packaging, and a different approach to managing customer touchpoints.

OriginsInfo’s quarterly e-publication, OriginsInsight, profiles individual communities and provides hints, tips and strategies to maximise the effectiveness of communication with these groups. Previous editions have profiled the Afghan, Chinese and Vietnamese communities.

Recent migrants in particular present opportunities for government and business alike as they establish a new life in Australia. In this early phase, their priority needs will be setting up a home, a bank account, purchasing products, and accessing services as they discover life in a new country.

Australia’s increasing diversity revealed in the 2011 census data confirms that cultural segments in Australia are too significant in size and too distinctive in needs to be given a ‘one-size-fits-all’ treatment. Research conducted for SBS at Bond University2 reveals that young, culturally diverse Australians will respond favourably to media and brands that connect better with their context of global multiculturalism.

Technology now enables differential treatment and to ignore multicultural segments will weaken brand connection with around 31% of Australia’s population (about 6.7 million persons) who claim a non-British Isles or Australian ancestry.

Successful planners and marketers position themselves as long-term partners interested in understanding and meeting diverse needs of cultural groups. Already the smartest businesses are implementing marketing and promotion strategies to target multicultural segments and communicate with them in ways that acknowledge different needs and values.

Read about how organisations have successfully implemented multicultural consumer strategies

Using OriginsInfo to Complement Census Data

Census data is an invaluable resource for planners and marketers to make informed and qualified business decisions. Its accuracy and robustness has led to the Australian Bureau of Statistics (ABS) being renowned as one of the leading census agencies in the world. It is the ‘gold standard’ for area-based analysis.

However, census data can only help us with part of the challenge. There are several limitations with census data:

- Non-Response – Questions relating to cultural background have higher non-response rates. The question on ancestry had a national non-response rate of almost 7% and this is almost certainly higher in more culturally diverse localities

- Undercount – The census has an undercount element where people, for a variety of reasons, were missed in the count or failed to complete a form

- The smallest geographical unit for the release of census data is Statistical Area 1 (SA1), an area containing an average of just over 400 persons. Many applications require a finer degree of granularity such as the ABS Mesh Block geographical unit which is used for the release of Origins data – these units contain an average of around 70 persons

- Most importantly, census data is not useful for analysis and communication at an individual level

Read more about the strengths and limitations of census data

Origins data takes census data one step further and analyses the cultural dimensions of customers at the individual level. This allows planners and marketers to create an evidence base using analysis at the individual level and to select and target individual people with appropriate communications to achieve organisational goals.

Using a person’s name is a very good surrogate for cultural identity and captures a person’s most likely cultural origin, rather than just country of birth. Name-based assessment is more likely to reflect a person’s values, attitudes and behaviours related to their cultural origin and upbringing.

Through the Origins system, a user can gain considerable insight into the cultural dimensions of their customers. By appending Origins codes to a customer database, a user can select and target customers with appropriate communications. Origins Web Mapping, customised to individual client needs, allows users to locate and report on the cultural mix of areas from an Australian or metropolitan scale right down to the ABS Mesh Block unit.

Read more about different ways of using Origins

For prospective customers and for expert agency advice in the design and execution of campaigns, OriginsInfo works with preferred partners.

Read more about our preferred partners

1 All figures and percentages quoted are net of overseas visitors and “Not Stated”

2 Ien Ang, Jeffrey E. Brand, Greg Noble, and Jason Sternberg. (2006) “Connecting Diversity: Paradoxes of Multicultural Australia” pp. 55-56 Full article can be found here